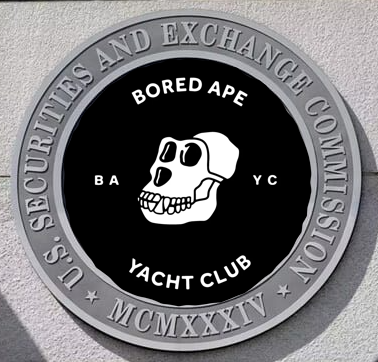

With the spotlight on Yuga labs this week, many creators of PFP collections may be spooked to learn from the SEC that certain activities with regard to NFTs, may run afoul of the agency’s rules.

At issue, one source said, is whether some of Yuga’s non-fungible tokens are closer to stocks and thus should follow the same SEC disclosure rules. One key legal question at the center of the new probe, according to Bloomberg, is whether NFTs are securities – a question the SEC has reportedly been investigating since March.

It is very important to note that the regulator’s inquiry may not lead to allegations of misconduct.

Commentators would also question the SEC’s recent announcement as another stunt by Chair Gary Gensler to gain media attention and publicity, to aid his political ambitions.

To add to this, it had been anticipated that non-fungible tokens (NFTs) would be excluded from the recently released EU draft MiCA regulation entirely, however it would appear that lawmakers have taken a more nuanced assessment of whether an non-fungible token in substance unique and therefore whether those who issue or deal in those NFTs will be required to comply with the MiCA regulation.

The draft text states that the ‘.. regulation should not apply to crypto-assets that are unique and not fungible with other crypto-assets, including digital art and collectibles, whose value is attributable to each cryptoasset’s unique characteristics and the utility it gives to the token holder. Similarly, it also does not apply to crypto-assets representing services or physical assets that are unique and not fungible, such as product guarantees or real estate.’

However, the draft text specifically states that fractional NFTs and large NFT collections may be considered fungible and will fall within the regulation. The text also later states, when assessing and classifying crypto-assets, competent authorities [the regulator for each EU member state] should adopt a substance over form approach, under which the features of the asset in question should determine the qualification, not its designation by the issuer.

In summary, as the global regulatory environment for cryptocurrencies and digital assets grapples to keep abreast of new developments and the evolution of the industry – we should feel optimistic that the web3 ecosystem has powerful advocates and legal participation to ensure the long-term viability for this burgeoning token economy.

Read more on Bloomberg