The Wall Street Journal reported on March 8 that U.S. President Joe Biden is planning to propose changes to cryptocurrency taxation in his upcoming budget plan.

The proposed changes will target wash trading, an illegal practice where investors sell certain investments to accept a tax-deductible loss before reinvesting.

What is wash trading?

The purpose of wash-trading is to artificially generate losses for tax purposes, which can be used to offset other gains or income and reduce tax liabilities. For example, a collector selling an NFT for 50% below its purchase price and then buying it back again in order to claim the ‘loss’ against profitable trades that they have realised.

However, wash trading is illegal and violates tax regulations because it involves generating artificial losses without any change in the investor’s economic position.

Currently, rules against wash trading apply to stock and bond trading, but not crypto trading. The new policy is estimated to raise $24 billion and is part of Biden’s 2024 budget plan to cut federal budget deficits by $3 trillion over the next decade.

How does this impact NFTs?

In February, the IRS expanded their interpretation of the asset class, requiring anyone who has dealt with digital assets to report their trading activity.

“At any time during 2022, did you: (a) receive as a reward, award, or compensation; or (b) sell, exchange, gift, or otherwise dispose of a digital asset or a financial interest in a digital asset?“

NFTs -which were seen as collectibles- are now seemingly being treated in the same category as coins and ERC-20 tokens. This means that collectors who have sold NFTs for a loss throughout the 2022 bear market will need to be careful when submitting their tax forms.

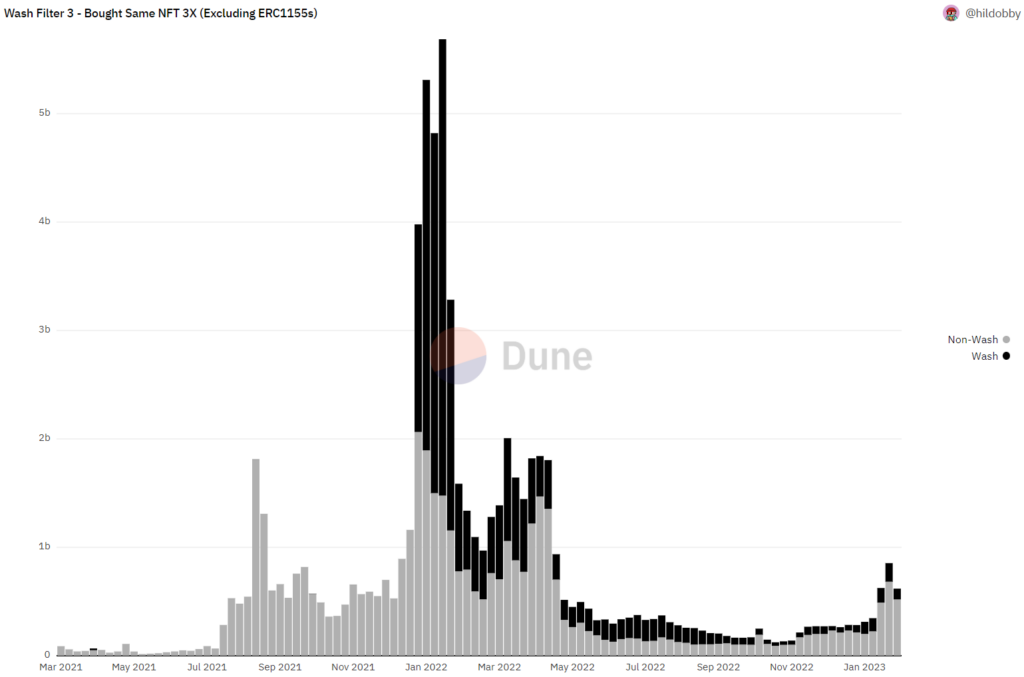

There was a substantial uptrend in NFT wash trading at the start of 2022; at some points making up majority of the overall market volume. As such, if Biden’s proposed crypto tax changes are passed, then many NFT collectors will need to determine whether their NFT trading activity could be classified as wash trading.

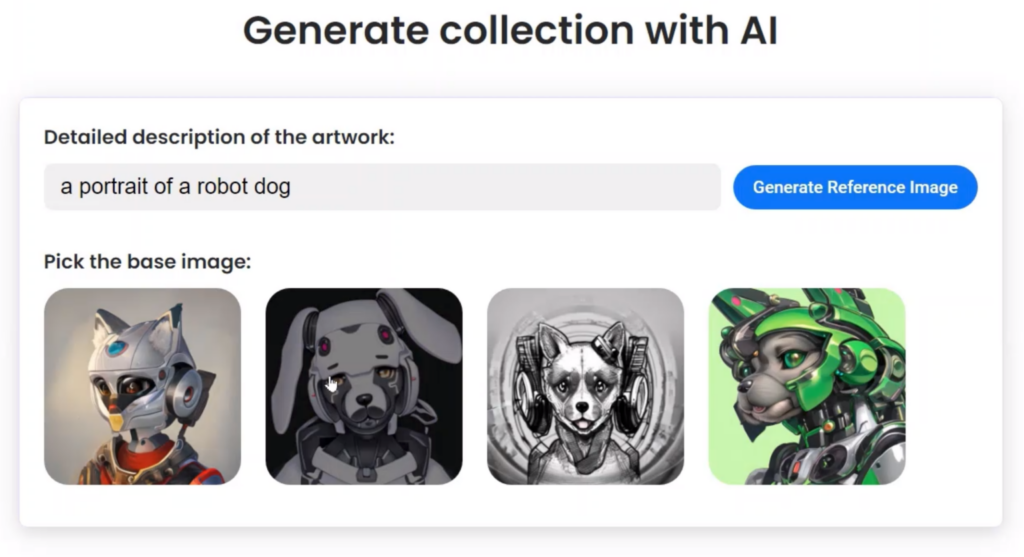

AI Art for larger NFT Collections

If you’d like to learn about getting early access to an AI NFT Generator for a larger collection of unique artwork, rather than a one-of-one profile picture, for your community or brand – register your interest here.

Got any questions?

If you need help or just want to discuss some cool ideas, feel free to join the AutoMinter discord! You will become part of a vast community of creators, developers, and entrepreneurs; gaining access to valuable knowledge and resources.

-

Flybondi and TravelX Pioneer Web3 Ticketing: Argentinian Airline Issues All Tickets as NFTs

Explore how Flybondi is utilizing blockchain and non-fungible tokens to transform the airline industry with seamless, secure, and flexible NFT-based e-tickets.

-

What Are Dynamic NFTs? Exploring Web3’s Interactive and Transformative Assets

Wondering what dynamic NFTs are? In short, they’re digital tokens that use smart contracts to change over time. Unlike traditional NFTs, dynamic NFTs adapt to external conditions, triggering changes in their metadata and characteristics. Discover the world of dynamic NFTs in this article and explore their unique features and potential use cases in Web3 and beyond.

-

Navigating Intellectual Property Rights in the NFT Space: What Buyers Need to Know

Discover the essentials of intellectual property rights in NFTs, from copyright and trademark laws to different rights granted to buyers. Our concise guide equips you with expert insights to navigate the complex NFT landscape confidently.